Intro to Casual Inference

Luis Chancí

lchanci1@binghamton.edu

Econometrics - Econ 466

Department of Economics

Binghamton University

Spring, 2019

Up to Now in Econ 466

Up to Now

Relationship between variables represented by a Linear Model

For instance, summarize the predictive power of schooling’s effect on wages with the conditional expectation function (CEF):

\[\mathbb{E}[log(Salary)_i|X_i]=\beta_0+\beta_1Edu_{i}+\beta_kExper_{i}\]

Up to Now

| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| (Intercept) | 5.503 | 0.112 | 49.12 | 8.126e-261 |

| educ | 0.07778 | 0.006577 | 11.83 | 3.616e-30 |

| exper | 0.01978 | 0.003303 | 5.988 | 3.022e-09 |

Also

Add some assumptions, and then

- Hypothesis testing

- ``Casual effect" (?)

After midterm 1, some assumptions may fail, for instance,

- Heteroskedasticity

- Serial correlation

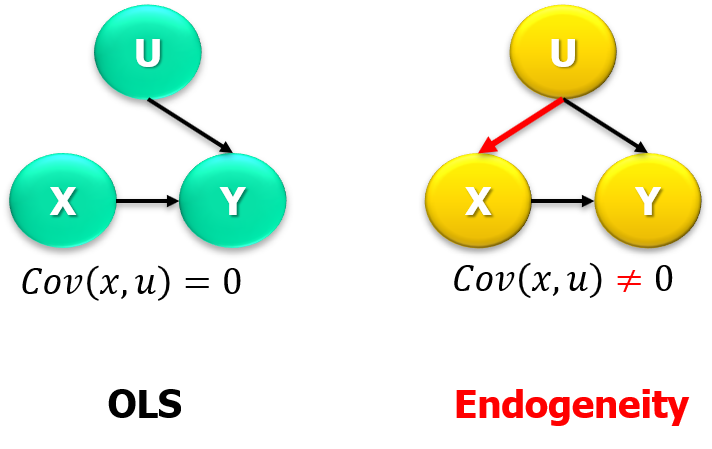

Endogeneity

One relevant part we reviewed was:

Endogeneity

- Recall Omitted Variable Bias,

\[\begin{eqnarray} \mathbb{E}(\hat{\beta}_{1}|X)\equiv\beta_1+\beta_2\frac{Cov(X,Omitted\,Part)}{Var(X)} \end{eqnarray}\]

- Because of endogeneity, the causal effect cannot be identified.

Causality

Again: Correlation and Causation

(there are many correlations that are not causal)

Causal Effect

How do we know if \(X\) causes \(Y\)?

E.g., causal relationships

- Light switch turned on => light to be on

- College degree => earnings (?)

Discussion

- what causality is and how we can find it

- research designs for uncovering causality

Causal Effect

Causal Effect

Pick up one observation: \(i=Luis\)

Crazy idea, assume there are two parallel universes (PU):

- In PU1: Luis has a college degree, \(X_i^0\), then observe earnings, \(Y_i^0\).

- In PU2: (same) Luis has a Ph.D., \(X_i^1\), then observe earnings, \(Y_i^1\).

EVERYTHING is the same, EXCEPT Schooling.

Hence, we can conclude with respect to differences in earnings.

Causal Effect

In practice there is one issue,

a prediction of what would have happened in the absence of the treatment.

Causal Inference

Outline

Notions: Treatment, Control, Experiment, Quasi-Experiment, others.

Methods:

- Selection on unobservables

- Differences-in-differences

- Panel methods

- Instrumental Variables

- Selection on observables:

- Regression

- Regression Discontinuity Design

- Matching

Treatment and Control

Let’s use a dummy variable for whether an observation, \(i\), received a treatment or not:

Treatment: \(D_i=1\)

Control: \(D_i=0\)

There is an ACTUAL outcome: \(Y_i\)

and an UNOBSERVED counterfactual:

\[ Unobserved\,outcome= \left\{ \begin{array}{c} Y_i^1&if&D_i=1\\ Y^0_i&if &D_i=0 \end{array} \right. \]

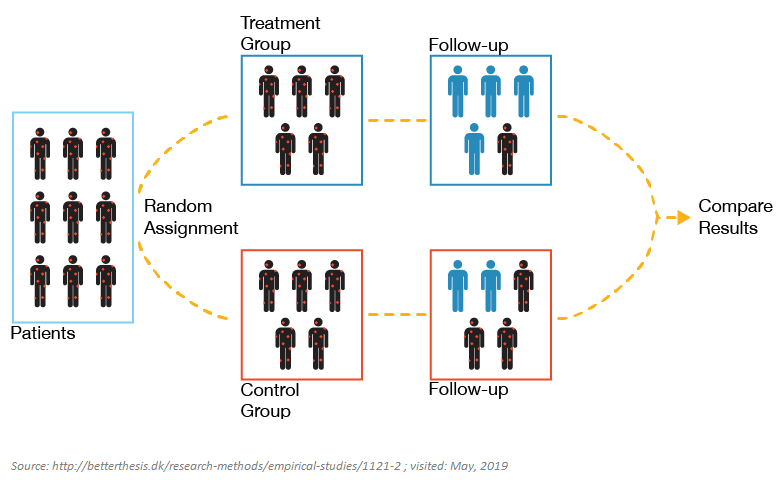

Experiments

Experiments

We would like to compare two observations that are basically exactly the same except that one has \(D=0\) and one has \(D=1\).

Experiments:

- research design (control the assignment to treatment)

- direct manipulation of subjects’ values on \(X\)

- measure changes in the values on \(Y\)

Randomized Controlled Trial, RCT

Experiments

Experiments

The econometric specification could be as simple as,

\[Y_i=\beta_0+\beta_1D_i+u_i\] which is the same as a two-sample t-test.

\(\,\)

On the other hand, there are some challenges to consider. For instance,

- Practical issues (e.g., randomizing types of exchange rate systems for developing countries).

- Ethical issues.

- “Too” controlled.

Natural Experiments

- The control and experimental variables of interest are not artificially manipulated by researchers

- Nature does the randomization

- Exogenous source of variation that determine treatment assignment

- Examples:

- policy changes

- government randomization

Quasi-experiments

Experiments and Quasi-experiments:

In an experiment, participants are randomly assigned to treatment or control.

In a quasi-experiment, observations are not assigned randomly.

Thus,

Groups may differ not only in treatment

(need to statistically control for differences).

There may be several “rival hypotheses” competing with the experimental manipulation as explanations for observed results.

Methods

Some Standard Methods

- Fixed effects

- Differences-in-Differences

- Instrumental Variables

- Regression Discontinuity

Fixed Effects

Fixed Effects

Idea,

- Again, recall Omitted Variable Bias

- We cannot control for many things

- measurement issues

- data issues

\(\,\)

- But, if we observe each observation \(i\) multiple times \(t\),

- control for each observation identity.

- it would be like “trying to control for everything unique” to that observation.

Panel Data

library(foreign)

Panel <- read.dta("http://dss.princeton.edu/training/Panel101.dta") # Source: http://dss.princeton.edu/training, visited Apr 2019.| country | year | y | y_bin | x1 | x2 | x3 | opinion |

|---|---|---|---|---|---|---|---|

| A | 1990 | 1342787840 | 1 | 0.2779036 | -1.1079559 | 0.2825536 | Str agree |

| A | 1991 | -1899660544 | 0 | 0.3206847 | -0.9487200 | 0.4925385 | Disag |

| A | 1992 | -11234363 | 0 | 0.3634657 | -0.7894840 | 0.7025234 | Disag |

| A | 1993 | 2645775360 | 1 | 0.2461440 | -0.8855330 | -0.0943909 | Disag |

| A | 1994 | 3008334848 | 1 | 0.4246230 | -0.7297683 | 0.9461306 | Disag |

| A | 1995 | 3229574144 | 1 | 0.4772141 | -0.7232460 | 1.0296804 | Str agree |

| A | 1996 | 2756754176 | 1 | 0.4998050 | -0.7815716 | 1.0922881 | Disag |

| A | 1997 | 2771810560 | 1 | 0.0516284 | -0.7048455 | 1.4159008 | Str agree |

| A | 1998 | 3397338880 | 1 | 0.3664108 | -0.6983712 | 1.5487227 | Disag |

| A | 1999 | 39770336 | 1 | 0.3958425 | -0.6431540 | 1.7941980 | Str disag |

| B | 1990 | -5934699520 | 0 | -0.0818500 | 1.4251202 | 0.0234281 | Agree |

| B | 1991 | -711623744 | 0 | 0.1061600 | 1.6496018 | 0.2603625 | Str agree |

| B | 1992 | -1933116160 | 0 | 0.3537852 | 1.5937191 | -0.2343988 | Agree |

| B | 1993 | 3072741632 | 1 | 0.7267770 | 1.6917576 | 0.2562243 | Str disag |

| B | 1994 | 3768078848 | 1 | 0.7193949 | 1.7414261 | 0.4117495 | Disag |

| B | 1995 | 2837581312 | 1 | 0.6715466 | 1.7083139 | 0.5358430 | Str disag |

| B | 1996 | 577199360 | 1 | 0.8198573 | 1.5324961 | -0.4996490 | Str agree |

| B | 1997 | 1786851584 | 1 | 0.8801672 | 1.5021962 | -0.5762677 | Disag |

| B | 1998 | -149072048 | 0 | 0.7045161 | 1.4236463 | -0.4484192 | Agree |

| B | 1999 | -1174480128 | 0 | 0.2369673 | 1.4545859 | -0.0493640 | Str disag |

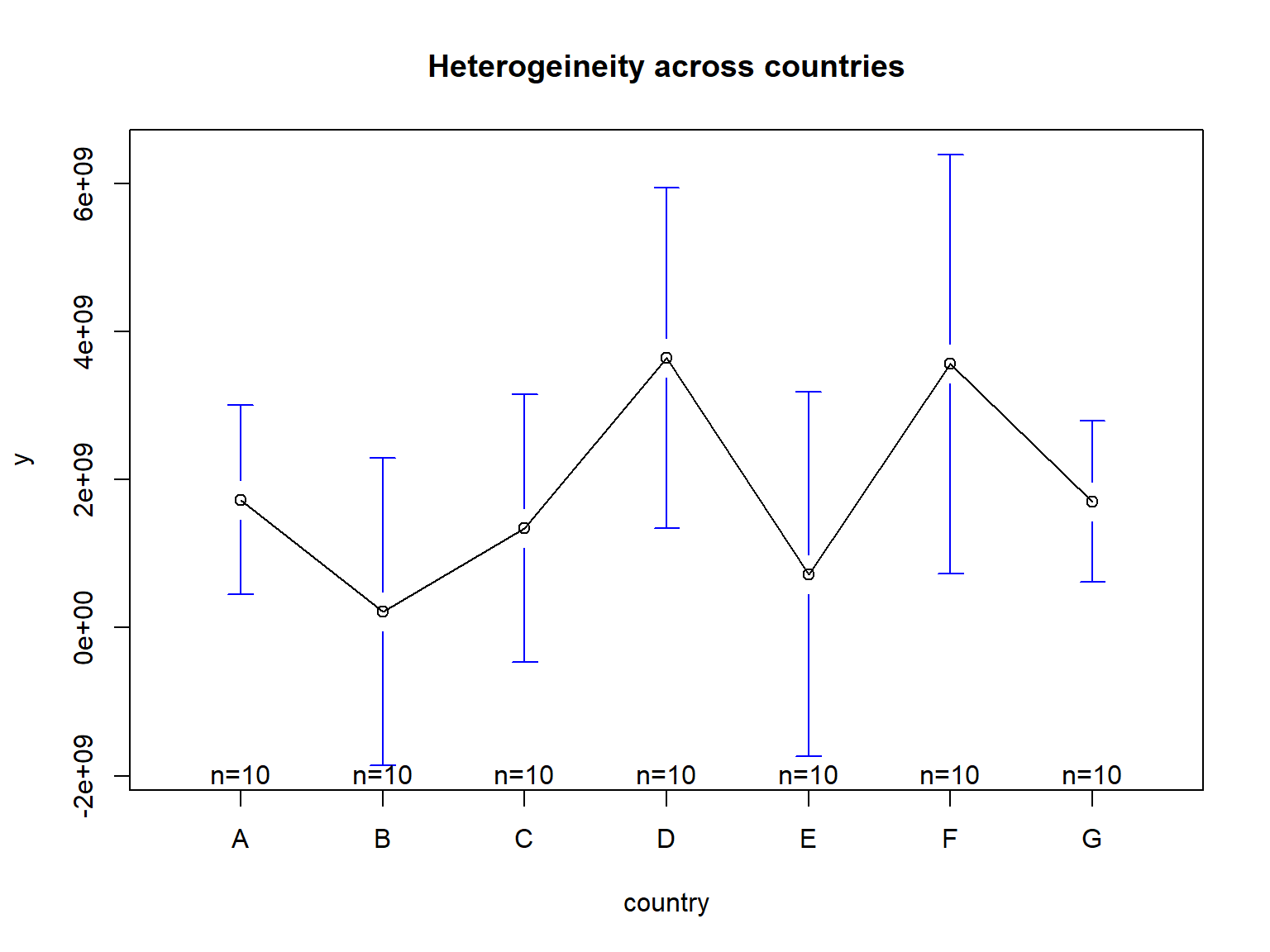

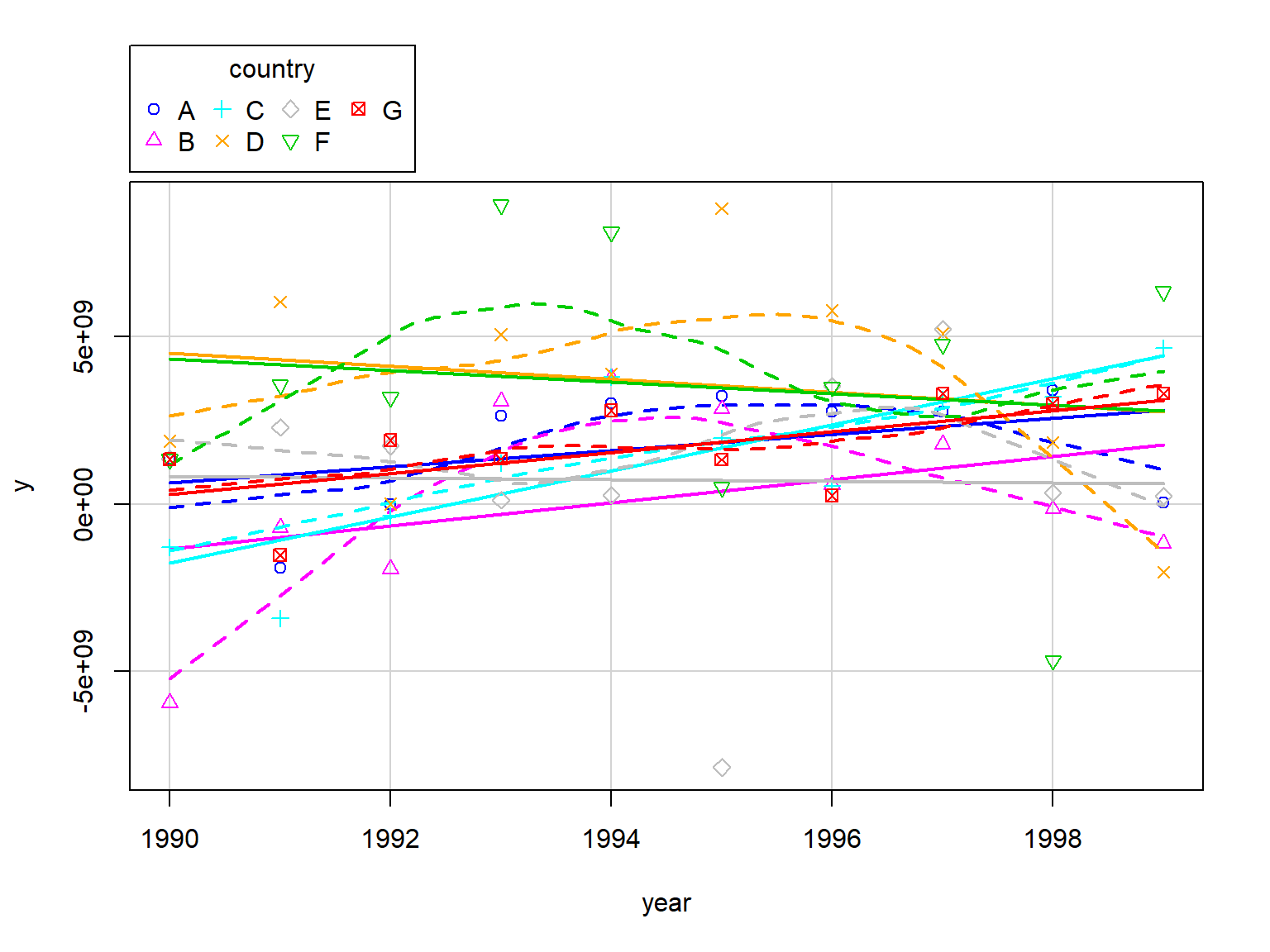

Exploring Panel Data

Exploring Panel Data

Fixed Effects

For instance, the model could be like

\[\begin{eqnarray} y_{it}&=&\beta_0+\beta_1x_{it}+\underbrace{\boldsymbol{\theta}_{i}}_{FE}+u_{it} \end{eqnarray}\]

\(\,\)

where, \(\theta\) could represent (unobserved) characteristic(s)

Fixed Effects

If we ignore \(\theta_i\),

| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| (Intercept) | 1.524e+09 | 621072624 | 2.454 | 0.01668 |

| x1 | 4.95e+08 | 778861261 | 0.6355 | 0.5272 |

(not stat. significant)

Fixed Effects

F.E. Estimation

Dummy variable regression, \[y_{it}=\alpha_AD_A+\alpha_BD_B+...+\beta_1x_{it}+u_{it}\] \(\,\)

Within Estimator, \[(y_{it}-\bar{y}_i)\,\,on\,\,(x_{it}-\bar{x}_i)\]

\(\,\)

- First Differencing, \[(y_{it}-y_{it-1})\,\,on\,\,(x_{it}-x_{it-1})\]

Fixed Effects

Dummy Variable Regression,

| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| x1 | 2.476e+09 | 1.107e+09 | 2.237 | 0.02889 |

| factor(country)A | 880542404 | 961807052 | 0.9155 | 0.3635 |

| factor(country)B | -1.058e+09 | 1.051e+09 | -1.006 | 0.3181 |

| factor(country)C | -1.723e+09 | 1.632e+09 | -1.056 | 0.2951 |

| factor(country)D | 3.163e+09 | 909459150 | 3.478 | 0.0009303 |

| factor(country)E | -602622000 | 1.064e+09 | -0.5662 | 0.5733 |

| factor(country)F | 2.011e+09 | 1.123e+09 | 1.791 | 0.07821 |

| factor(country)G | -984717493 | 1.493e+09 | -0.6597 | 0.5119 |

(stat. significant)

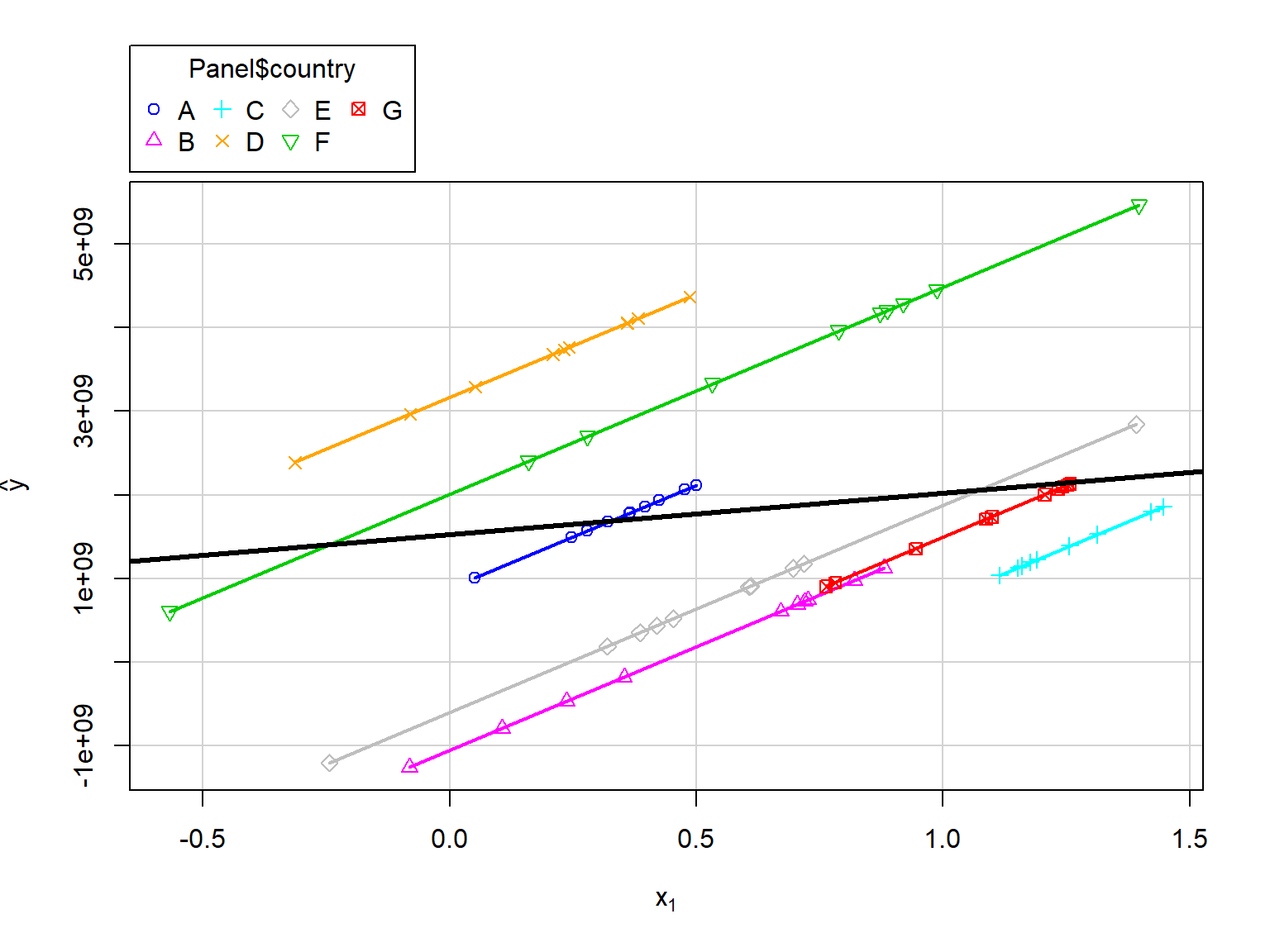

Fixed Effects

Dummy Variable Regression,

Fixed Effects

Within Estimator,

\[(y_{it}-\bar{y}_i)=\beta_1(x_{it}-\bar{x}_i)+\epsilon_{it}\]

library(plm)

FE <- plm(y ~ x1, data=Panel, index=c("country", "year"), model="within")

pander(coefficients(summary(FE)))| Estimate | Std. Error | t-value | Pr(>|t|) | |

|---|---|---|---|---|

| x1 | 2.476e+09 | 1.107e+09 | 2.237 | 0.02889 |

(stat. significant)

Fixed Effects

Discussion (from Wooldridge)

Strict exogeneity in the original model has to be assumed

In the case T = 2, fixed effects and first differencing are identical

For T > 2, fixed effects is more efficient if classical assumptions hold

If T is very large (and N not so large), the panel has a pronounced time series character and problems such as strong dependence arise

First differencing may be better in the case of severe serial correlation in the errors

Differences-in-Differences

Differences-in-Differences

Motivation

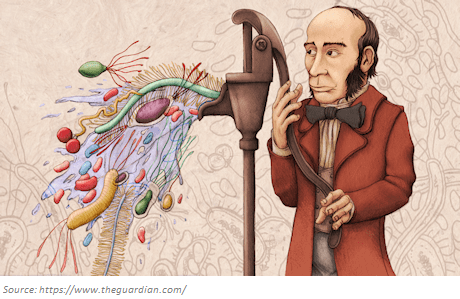

Doctor John Snow, physician. London, 1813-1858.

Doctor John Snow, physician. London, 1813-1858.

Cholera,

- in the early 1800s

- three main waves

Jhon noticed variations

- water supply

- rates of cholera

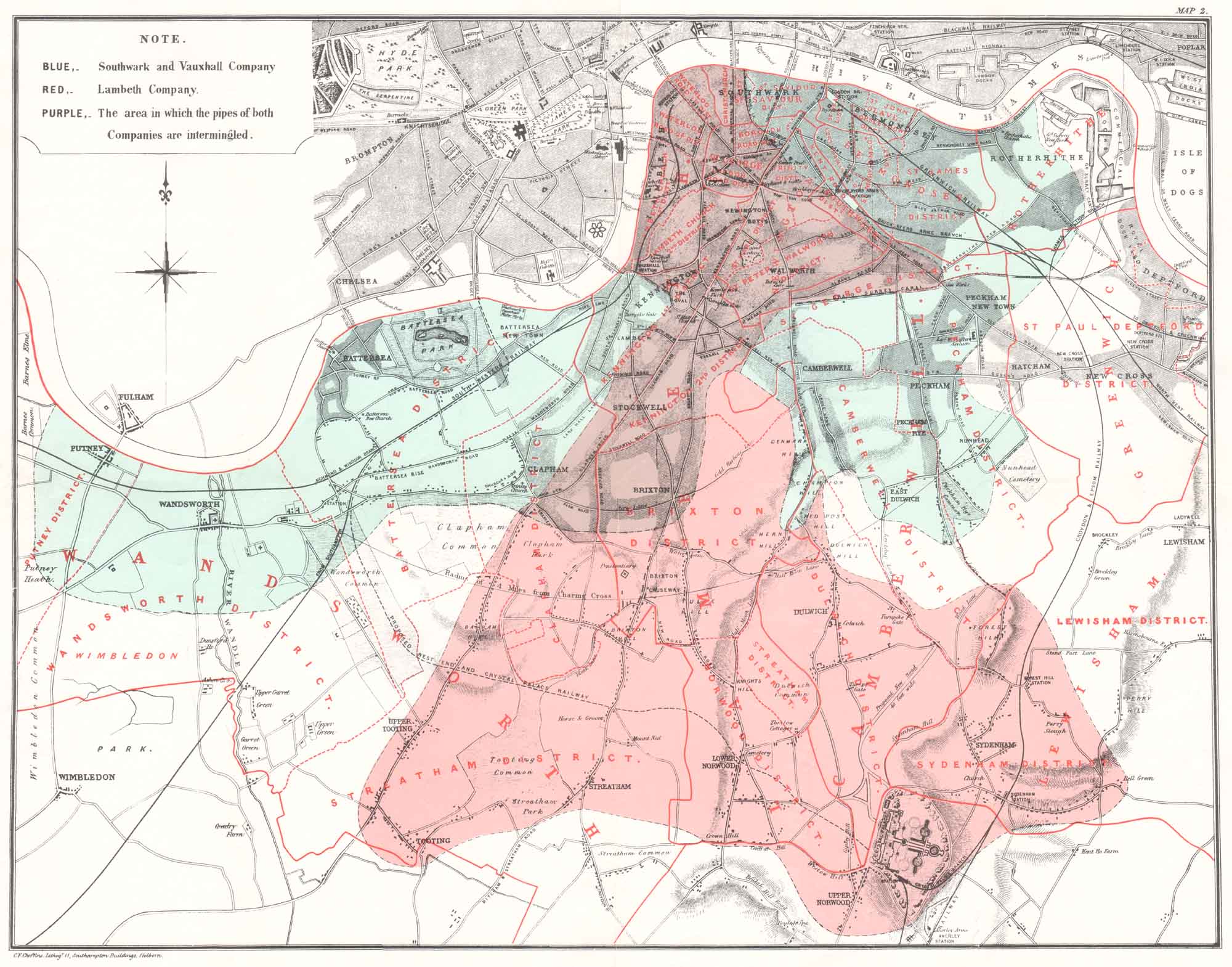

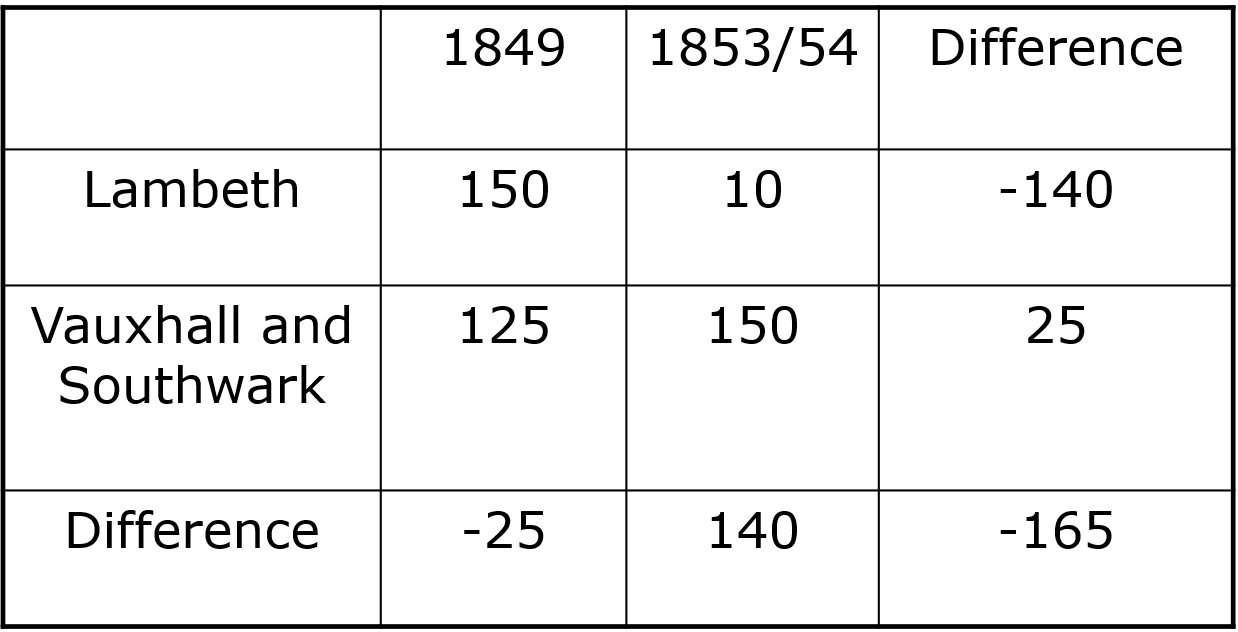

Differences-in-Differences

Differences-in-Differences

1849:

- London’s worst cholera epidemic

- Two main companies supplied water:

- Lambeth Waterworks Co.

- Southwark and Vauxhall Water Co

1852: Lambeth Waterworks moved their intake upriver

1853: London has another cholera outbreak

Differences-in-Differences

Do you want to learn more?

Differences-in-Differences

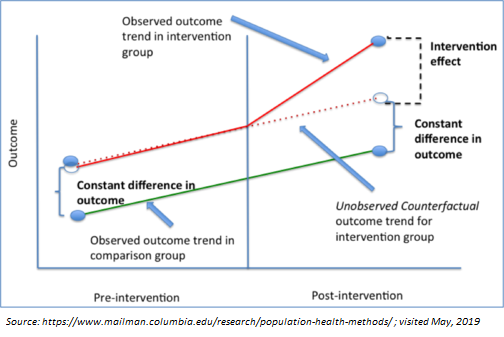

Illustration,

Differences-in-Differences

Differences-in-Differences

Econometric specification,

\[y=\beta_0+\beta_1D_{treatment}+\beta_2D_{post}+\beta_3(D_{treatment}*D_{post})+u\]

\(\beta_3\) is the parameter of interest.

Notices that this is related to FE. For instance, if we have more than two groups (T/C = g) and more than two periods (Pre/Post = t):

\[y_{igt}=\beta_0+\beta_1D_{g}+\beta_2D_{t}+\beta_3D_{gt}+\beta_4X_{igt}+u_{igt}\]

Differences-in-Differences

Key Assumptions:

Time affected the Treatment and Control groups equally

Differences-in-Differences

Do you want to learn more?

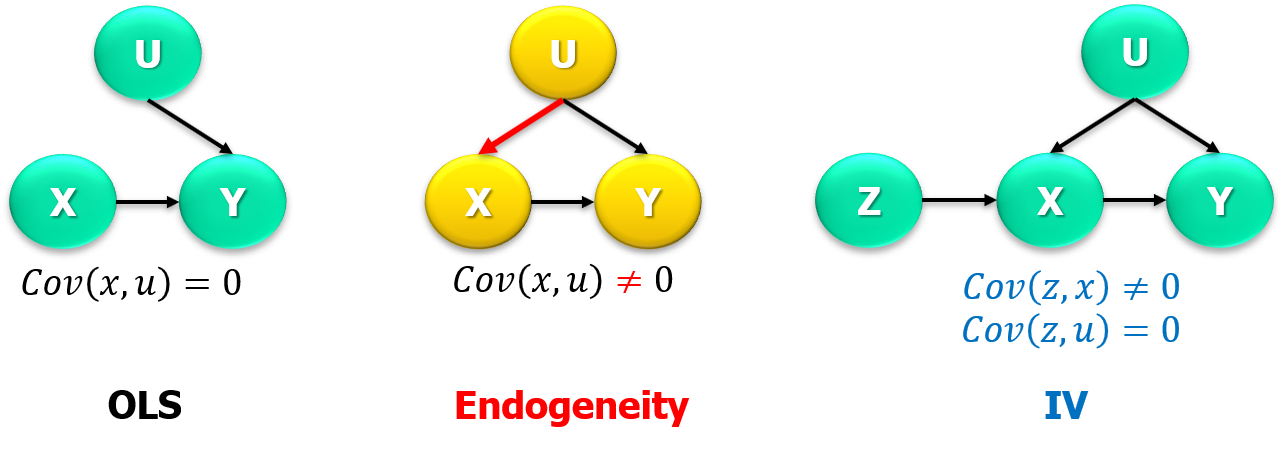

Instrumental Variables

Instrumental Variables

Idea,

For the linear model, \(y=\beta_0+\beta_1x+u\),

say that we do not have random assignment

but, what if we can find another variable \(z\) with random assignment that causes \(X\)

if this is the case, we coud get a natural experiment!

This variable is called it an “instrument” or “instrumental variable”

Instrumental Variables

Conditions for instrumental variable:

- Does not appear in regression equation

- Is uncorrelated with error term

- Is partially correlated with endogenous explanatory variable

Instrumental Variables

In other words,

There is an endogeneity issue, \[Cov(x,u)\neq 0\]

but, what if we can find \(z\), such as this variable

- causes \(x\) (relevance):

\[Cov(z,x)\neq 0\]

- is randomly assigned, and the only relationship with \(y\) is through \(x\) (exogeneity):

\[Cov(z,u)= 0\]

Instrumental Variables

Instrumental Variables

Before moving on, check

Instrumental Variables

Estimation for \(k=2\), \(y=\alpha+\beta x+u\).

\[If\,\,\,\,Cov(z,u)=0,\,\,\Rightarrow\,\,Cov(z,y)-\beta Cov(z,x)=0\]

thus,

\[\hat{\beta}_{IV} = \frac{\sum{(z_i-\bar{z})(y_i-\bar{y})}}{\sum{(z_i-\bar{z})(x_i-\bar{x})}}\]

Cigarette smoking and child birth weight.

| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| (Intercept) | 4.769 | 0.005369 | 888.3 | 0 |

| packs | -0.08981 | 0.01698 | -5.29 | 1.422e-07 |

| Estimate | Std. Error | t value | Pr(>|t|) | |

|---|---|---|---|---|

| (Intercept) | 4.448 | 0.9082 | 4.898 | 1.082e-06 |

| packs | 2.989 | 8.699 | 0.3436 | 0.7312 |

Instrumental Variables

Properties of IV with a poor instrumental variable (for \(k=2\)),

\[\begin{eqnarray} plim\,\hat{\beta}_{OLS}&=&\beta_1+Corr(x,u)\frac{\sigma_u}{\sigma_x}\\ & &\\ plim\,\hat{\beta}_{IV}&=&\beta_1+\frac{Corr(z,u)}{Corr(z,x)}\frac{\sigma_u}{\sigma_x} \end{eqnarray}\]

IV worse than OLS if \(\frac{Corr(z,u)}{Corr(z,x)}>Corr(x,u)\)

Instrumental Variables

IV estimation in the multiple regression model (\(k>2\)),

\[y=\beta_0+\beta_1\underbrace{x_{1}}_{Endog}+\beta_2\underbrace{x_{2}}_{Exog}+u\]

Two Stage Least Squares (2SLS)

Stage one (reduced form):

Estimate, \(x_1=\gamma_0+\gamma_1z+\gamma_2x_2+\epsilon\) , to get \(\hat{x}_1\)

Stage two:

Estimate, \(y=\beta_0+\beta_1\hat{x}_{1}+\beta_2x_{2}+u\)

Card(1995), College Proximity as an IV for Education (Example 15.4)

data("card")

reg.ls <-lm (lwage~educ + exper+expersq+black+smsa+south+smsa66+reg662+reg663+reg664+reg665+reg666+reg667+reg668+reg669, data = card)

reg.iv <-ivreg(lwage~educ + exper+expersq+black+smsa+south+smsa66+reg662+reg663+reg664+reg665+reg666+reg667+reg668+reg669|

nearc4 + exper+expersq+black+smsa+south+smsa66+reg662+reg663+reg664+reg665+reg666+reg667+reg668+reg669, data = card)| lwage | ||

| OLS | IV | |

| educ | 0.075*** | 0.132** |

| (0.003) | (0.055) | |

| exper | 0.085*** | 0.108*** |

| (0.007) | (0.024) | |

| expersq | -0.002*** | -0.002*** |

| (0.0003) | (0.0003) | |

| Observations | 3,010 | 3,010 |

| Note: | p<0.1; p<0.05; p<0.01 | |

Instrumental Variables

Testing for endogeneity of \(x_1\) in

\[y=\beta_0+\beta_1x_1+\beta_2x_2+u\]

Reduced form, \(x_1=\gamma_0+\gamma_1z+\gamma_2x_2+\epsilon\)

\(x_1\) is exogenous if and only if \(\epsilon\) is correlated with \(u\)

Test equation

\[y=\beta_0+\beta_1x_1+\beta_2x_2+\delta\hat{\epsilon}+e\]

\(H_0\), \(exogeneity\) of \(x_1\), is rejected if \(\delta\) is significantly different from zero.

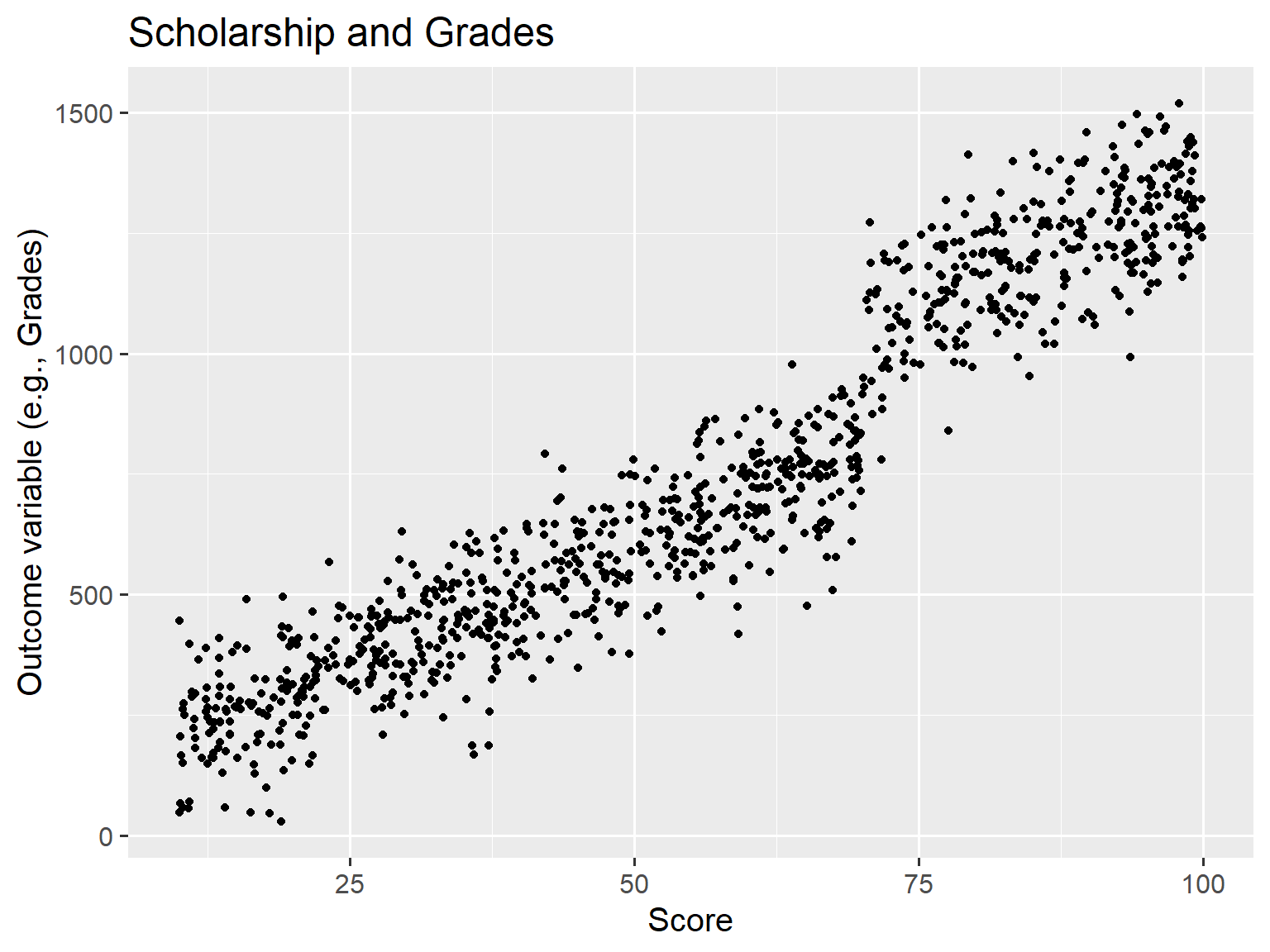

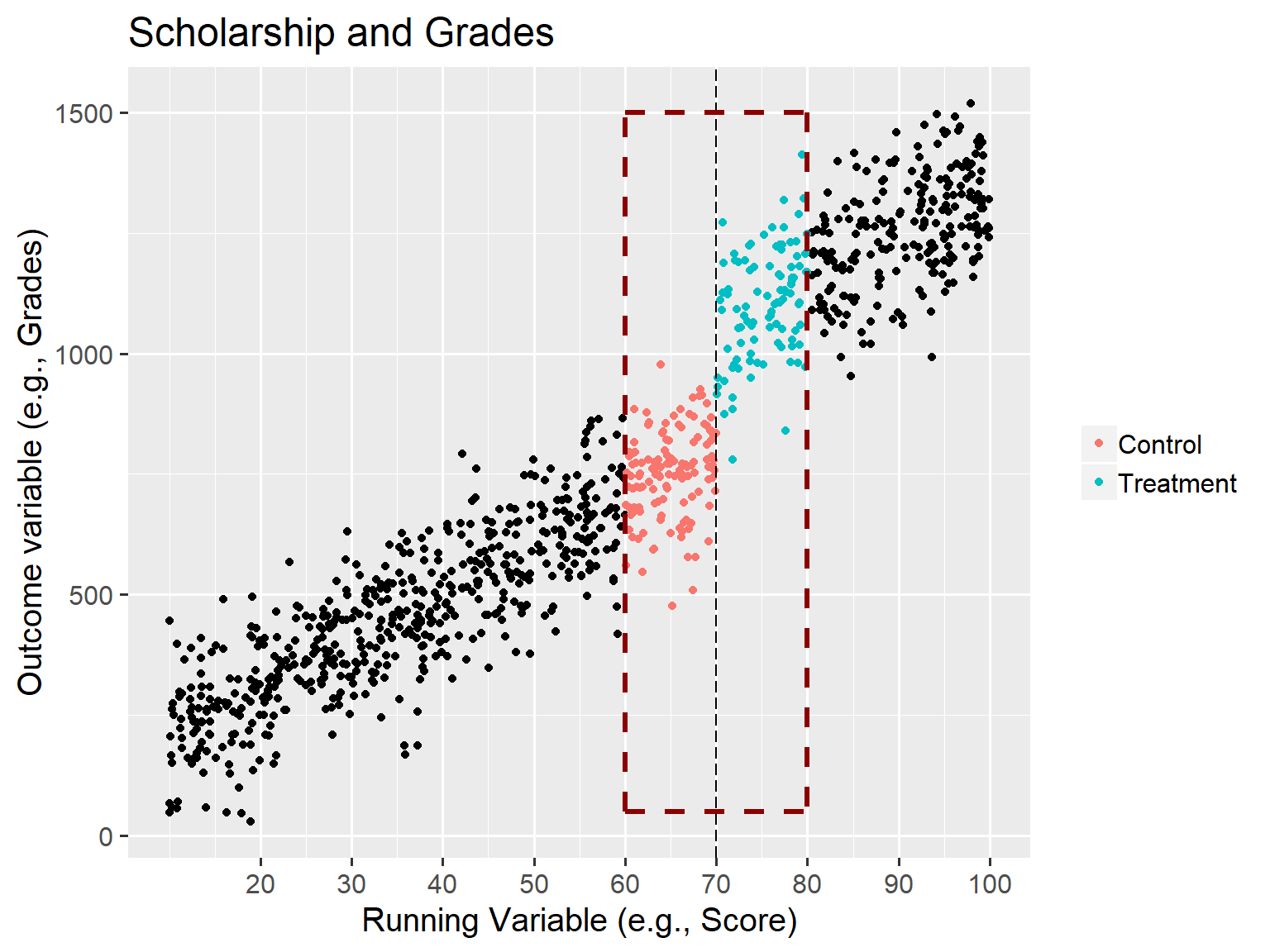

Regression Discontinuity Design

Regression Discontinuity Design

Motivating Examples

- National Merit Scholarship and GPA.

- Endogeneity issue:

- students performing well => more likely to win

- and continue performing well

- thus, it’s not clear the causal effect of the schoolarship on GPA

- Endogeneity issue:

- Class size and Students reading achievement (Angrist and Lavy, 1997).

Regression Discontinuity Design - basic idea

RDD exploits exogeneity in program characteristics (designing aspects).

We could think of it as a randomized experiment at cutoff \ Treatment is assigned based on a cutoff (or running variable).

Intuition: Participants in the program are very different, however, at the margin (cutoff), those just at the threshold are virtually identical.

Regression Discontinuity Design - basic idea

For instance,

- scholarship allocation based on scoring above a certain threshold on the PSAT.

- being admitted to a training program based on a test score.

- class size design using Maimonides’ rule.

RDD - Scholarship and Grades

RDD - Scholarship and Grades (2)

RDD - General Idea

(Animation) Source: Nick C. Huntington-Klein. Twitter @nickchk

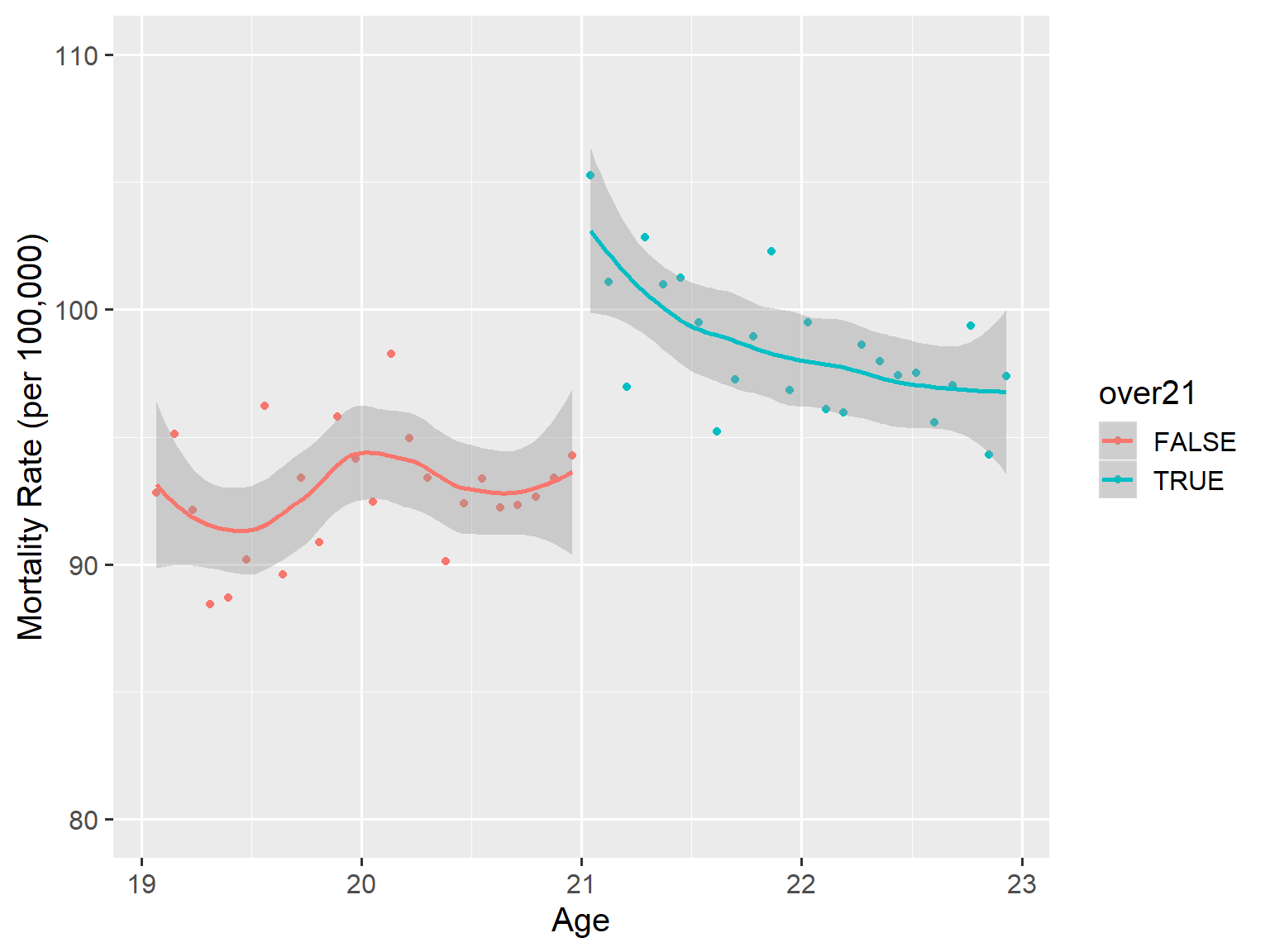

Ather example. Alcohol and Mortality (Before 1984, MLDA<21)

library(foreign); library(ggplot2)

RDData <- read.dta("http://masteringmetrics.com/wp-content/uploads/2015/01/AEJfigs.dta"); RDData$over21 <- (RDData$agecell>=21); attach(RDData);

ggplot(RDData,aes(x=agecell, y=all,colour=over21))+geom_point()+ylim(80,110)+stat_smooth(method=loess)+labs(x="Age",y="Mortality Rate (per 100,000)")

Regression Discontinuity Design

Model

\[y=\beta_0+\beta_1D_{treatment}+\beta_2Running+u\]

Final comments,

- Sharp RDD

- Fuzzy RDD

- Functional form specification

- External / Internal Validity